(Originally Posted Tuesday April 18, 2006 @ 19:44) The Easter Bunny sure as hell didn’t do me any favors. Holy bunny buns Batman! I’ve said before, it’s smart to stay away during F.M.O.C. days. But dumb and tired me went short seconds…I repeat SECONDS… before the huge rally today. My entire mental schedule was thrown off. I thought it was Monday. NO EXCUSE! I forgot is was Tuesday. NO EXCUSE. I spent the entire evening yesterday uploading my chart for readers and nearly went blind trying to remember how to do it. NO EXCUSE.

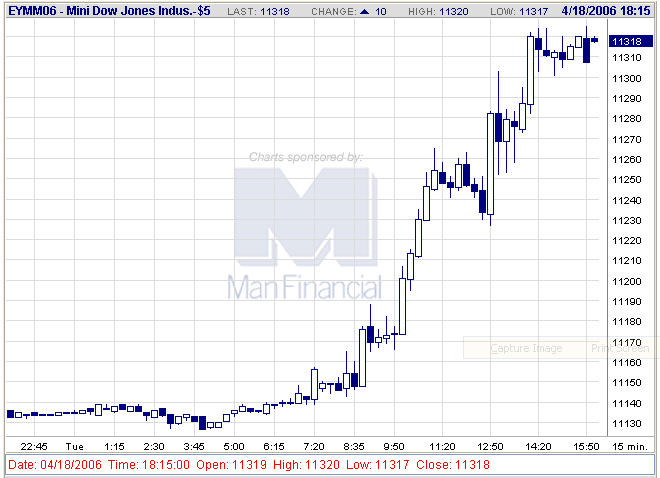

I waited with baited breath as the double top pattern was confirmed at 13:05. This is exactly the setup I like to see. Plus a divergence was setting up and although it’s a secret that I can’t divulge here, I took it the way I always do. I’ve posted a 15 minute chart for you to see here tonight. I can’t take the huge amount of time it takes me to upload for you my real-time chart I use to day trade. I’m just not good at that yet. Plus in all honesty I’ve pumped up the time frame to make it quicker for you to easily see the trading patterns presented today. By my own lack of attention I was technically right and fundamentally wrong. That’s usually expensive. It certainly was today.

What a wicked rally…unless of course you were LONG. But actually as my gift to you faithful reader, what can we learn here. Study the volume today. I think we saw such a violent reaction because the whole online trading community was short. When the floor turned, little speculators like you and I were roasted and toasted.

You nor I cannot possibly know all the fundamentals. We rely on out bar charts or Japanese Candle Stick Charts to plot our profitable trading success. NEVER forget even if you fall into fatigue like I did today…fundamentals drive the commodity traders on the floor. Charts are a tool for us to use. I didn’t take my own advice and stay out on such an important day. I missed the signals because I forgot to look up and down the tracks before stepping on the rails. So the train smoked me!

Now having said that, if I’d gone long, I’d be a hero. And that illustrates my point exactly. I had no business being long or short. Despite the best bar chart analysis you’re capable of, fundamentals will take over and change the picture in a heartbeat. The smart position at times like today is flat the market. Do to my inattention to detail, somebody else’s equity improved. I’m not about to admit by how much. I reacted as fast as I could in a stunned silence. If you look at the one minute bar chart you’ll get the idea. It was remarkable. My data was leaping up 3 ticks at a time. Getting out at the market in a flash bull run is expensive. Hey, I never said I wasn’t human. Just don’t let it happen to you.